The passing of Prop 19 in California means a windfall for the state - but at the expense of higher property taxes for some residents. California property tax rates typically fall between 11 percent to 16 percent of its assessed value.

Sales and use taxes in California state and local are collected by the California Department of Tax and Fee Administration whereas income and franchise taxes are collected by the Franchise Tax Board.

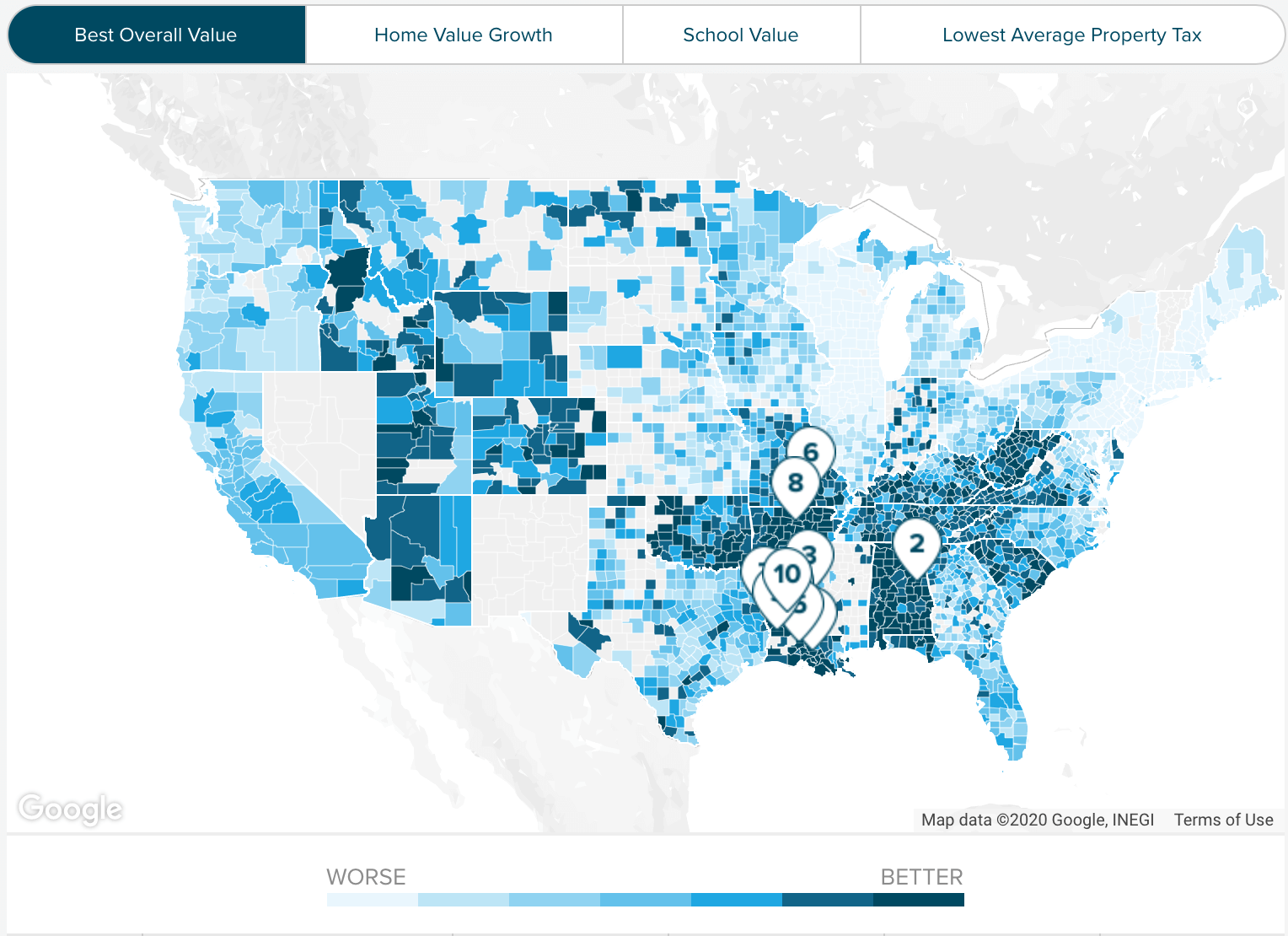

Ca property tax rate. California Property Tax Calculator. Californias property taxes are below the national average. The average effective property tax rate in California is 073 compared to the national rate which sits at 107.

The effective rate is74 as of 2020. Californias overall property taxes are below the national average. The undersigned certify that as of June 28 2019 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 28 2019 published by the Web.

The countys average effective tax rate is 095. Most require seniors to apply by a certain date often in May or June to get an exemption for the tax year that starts July 1. There is a free online Property Tax Calculator that makes estimating a buyers new tax pretty simple.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. That ranks as the 35th lowest.

Property taxes are calculated by multiplying the propertys tax. Showing commercial results only. We issue tax bills twice a year.

Calculating Property Taxes in California. 19s passage a parent could transfer the parents primary residence and up to 1000000 of assessed value other property vacation home commercial property rental properties investment properties and so on to their children and such properties would retain the low adjusted base year value for property tax purposes. Get copies of current and prior year tax bills.

Check out popular questions and answers regarding property taxes. It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education. Riverside County taxpayers face some of the highest property tax rates in California.

A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. 9 Property in California is assessed at 100 of its full cash or fair market value but you might catch a few property tax breaks provided for under state law. View an overview of property taxes how the property tax system works and distribution of taxes for services.

But in California the tax rate is much lower at 081 the 34th lowest in the US. California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled. This page requires Javascript because it displays property taxes throughout the Bay Area on an interactive map.

But the median home there valued at 385500 raises 3104 in property taxes. After exemptions the average California effective property tax rate is 079 with a national average of 119. If you own a property or parcel of land you will have to pay property tax.

Property Tax Rates Allocations. Pay your property taxes. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

The states property taxes actually arent all that bad. All property owners will have their final bills mailed by the end of May. At 725 California has the highest minimum statewide sales tax rate in the United States which can total up to 1050 with local sales taxes included.

Overview of California Taxes Californias overall property taxes are below the national average. Property tax is a tax based on the assessed value of a property. However rates can vary wildly depending on where you live within the county.

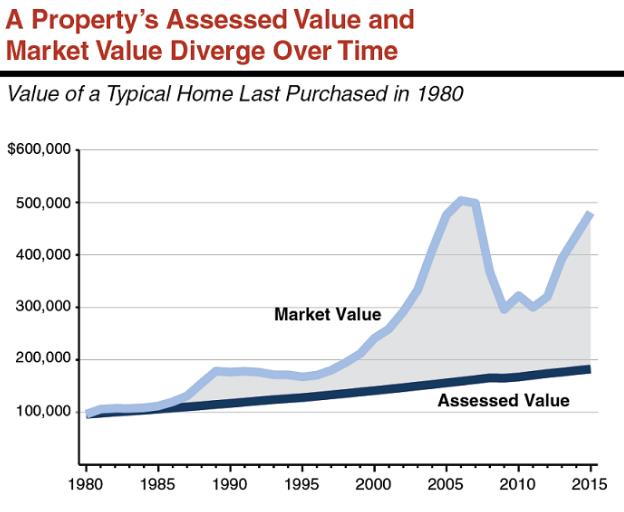

Property Tax Bill Questions Answers. Calculating Property Taxes Californias Proposition 13 passed in 1978 defines how property taxes are calculated and reassessed. If you pay your Interim bill directly not through your mortgage company or through pre-authorized payments you can expect to receive this tax bill by mail by the end of January.

Taxing Property Instead Of Income In B C

Taxing Property Instead Of Income In B C

California Property Tax Calculator Smartasset

California Property Tax Calculator Smartasset

California Government Benefitting From Rising Property Values Low Rates And Higher Home Values Increase Property Tax Collections Who Pays Tax Bill On Foreclosed Properties Dr Housing Bubble Blog

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

Property Tax In The United States Wikipedia

Property Tax In The United States Wikipedia

Understanding California S Property Taxes

Understanding California S Property Taxes