Do not file a second tax return or call. How taxes are used depends on which level of government is collecting them.

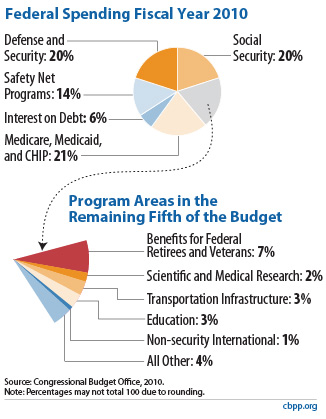

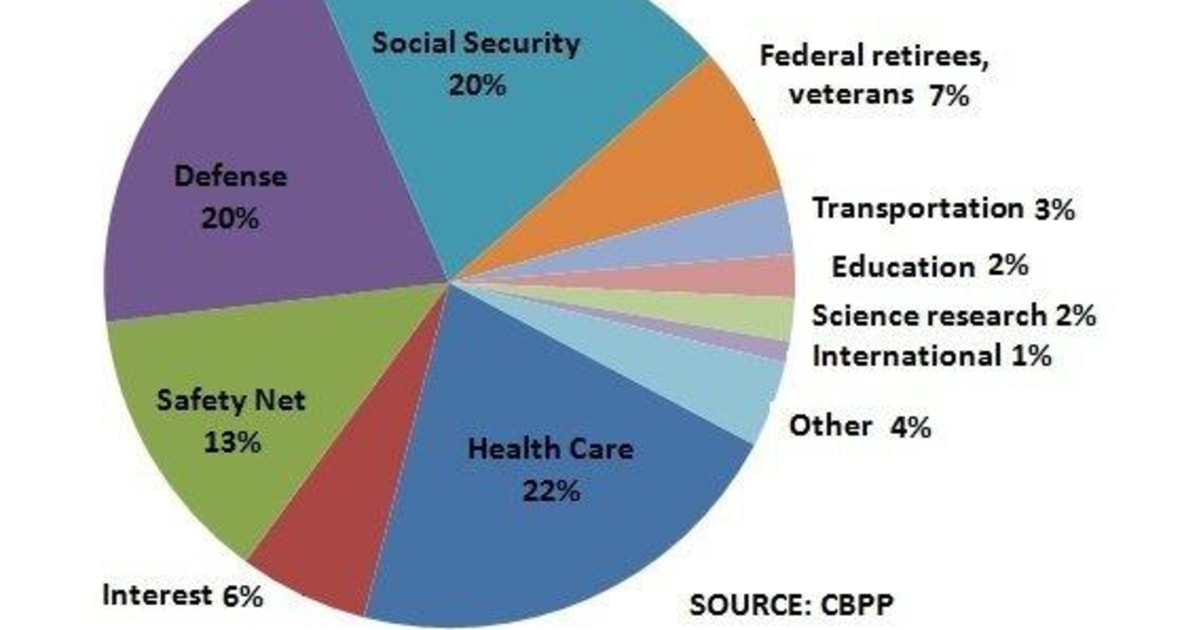

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

The IRS uses the adjusted gross income or AGI from your 2019 federal tax return to calculate how much of the 600 payment and how much of your future payment your household will receive.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)

What are federal taxes used for. Find filing information for Federal state local and Indian tribal governments and for governmental liaisons. Page Last Reviewed or Updated. Perhaps the most important thing to know about the progressive tax system is that all of your income may not be taxed at the same rate.

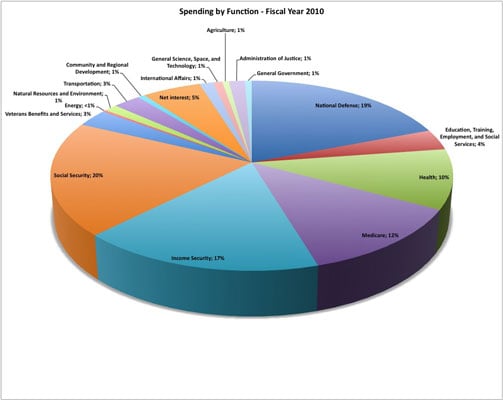

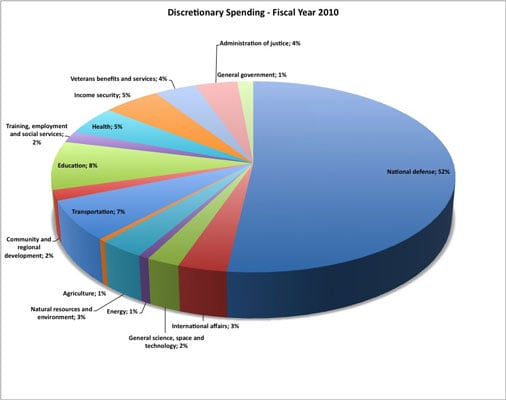

As the chart shows the remaining fifth of federal spending. If you used IRS Free File last year you may receive an email from the same company that you used welcoming you back to their official IRS Free File services. Every year Americans pay their tax bills but are often puzzled about how government spends the taxes it collects.

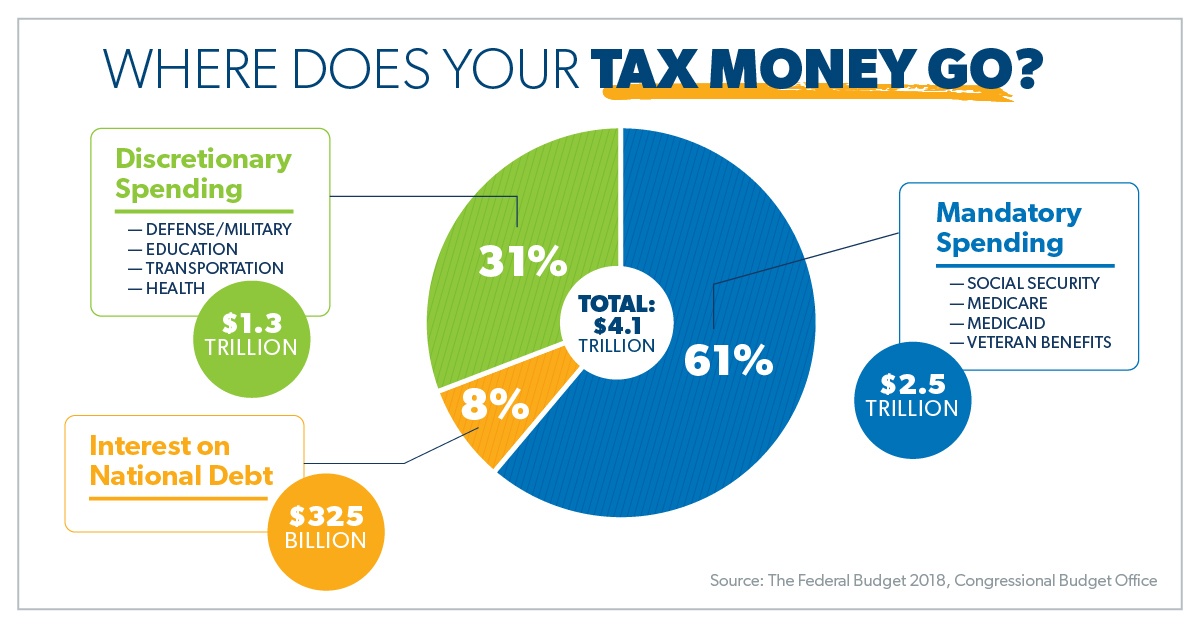

In 2019 these interest payments claimed 375 billion or about 8 percent of the budget. It collects taxes and then disburses them according to the budget agreed upon by both chambers of Congress and the President. State and local taxes are used primarily for education transportation and law enforcement.

The states must grant residents of other states equal protections as taxpayers. The income tax rules allow the government to collect taxes from any person or business that earns money during the year. The tax rules provide a broad and sweeping definition of taxable income to include all property you receive regardless of whether you earn it at work.

Get information about tax-exempt bonds. For example employees that earn income in New York City may be required to pay an additional New York City tax in addition to federal and state taxes. So if you fall into the 22 tax bracket a 1000 deduction could save you 220.

Many Americans overestimate how much of tax money goes toward government programs and taxpayers may underestimate the amount of taxes spent on other crucial elements of the federal governments budget. The federal government is generally prohibited from imposing direct taxes unless such taxes are then given to the states in proportion to population. Thus ad valorem property taxes have not been imposed at the federal level.

Major health programs such as Medicare and Medicaid. According to the US. Were experiencing delays in processing paper tax returns due to limited staffing.

You pay the tax as you earn or receive income during the year. What is Tax Withholding. The three biggest categories of expenditures are.

The email should include a link to the companys IRS Free File site. The most common form of federal taxation is the income tax. Federal and state income taxes are similar in that they apply a percentage rate to taxable incomes but they can differ considerably with respect to those rates and how theyre applied as well as.

If youre an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name. Federal income taxes are used to pay for virtually anything under the sun. What is Estimated Tax.

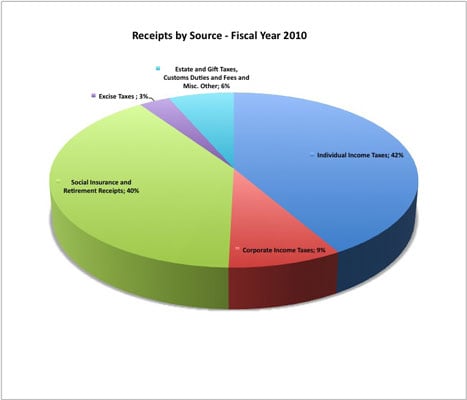

This money is primarily used to finance programs that help defend educate financially support care for transport andor perform other similar functions for individuals living within the United States. Center on Budget and Policy Priorities the United States federal government collects 25 trillion in taxes each year. Federal taxes are used for such major outlays as national defense Social Security and health care and interest on the national debt.

The federal government must make regular interest payments on the money it borrowed to finance past deficits that is on the federal debt held by the public which reached 168 trillion by the end of fiscal year 2019. Each year the federal government must fund billions of dollars worth of programs and does so through federal income taxes. Federal tax is the money used by the government of a country to pay for the growth and upkeep of the country.

Local income tax will vary by employees and employers location and can be dependent on where employees work or live. Heres an overview of how citizens. The federal income tax is a pay-as-you-go tax.

Federal Income Tax Brackets. Processing Delays for Paper Tax Returns. Some look at federal tax as rent charged to live in a country or the fee to use the.

We continue to process electronic and paper tax returns issue refunds and accept payments. If you already filed a paper return we will process it in the order we received it. Tax tables show the total amount of tax you owe but how does the IRS come up with the numbers in those tables.

The federal taxes you pay are used by the government to invest in technology and education and to provide goods and services for the benefit of the American people. Generally deductions lower your taxable income by the percentage of your highest federal income tax bracket. If you choose a program and qualify you will not be charged for preparation and e-filing of a federal tax return.

Here S Where Your Federal Income Tax Dollars Go

Here S Where Your Federal Income Tax Dollars Go

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

How Are Your Tax Dollars Used By The Federal Government Dummies

How Are Your Tax Dollars Used By The Federal Government Dummies

Why Most Elderly Pay No Federal Tax Squared Away Blog

How Does The Federal Government Spend Its Money Tax Policy Center

How Does The Federal Government Spend Its Money Tax Policy Center

United States Income Tax History Tax Code And Definitions

United States Income Tax History Tax Code And Definitions

Understanding Marginal Income Tax Brackets Means Wealth Management And Financial Advisors

Understanding Marginal Income Tax Brackets Means Wealth Management And Financial Advisors

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Difference Between A Tax Id Employer Id And Itin

Difference Between A Tax Id Employer Id And Itin

Income Tax In The United States Wikipedia

Income Tax In The United States Wikipedia

Where Does Your Tax Money Go Daveramsey Com

Where Does Your Tax Money Go Daveramsey Com

Why Should I Pay Federal Or State Taxes Quora

Taxation In The United States Wikipedia

Taxation In The United States Wikipedia

How Are Your Tax Dollars Used By The Federal Government Dummies

How Are Your Tax Dollars Used By The Federal Government Dummies

How Are Your Tax Dollars Used By The Federal Government Dummies

How Are Your Tax Dollars Used By The Federal Government Dummies