FICA - SS - This stands for Federal Insurance Contributions Act - Social Security It is the mandatory social security that youll pay. As you work and pay FICA taxes.

Fica Definition And Synonyms Of Fica In The English Dictionary

Fica Definition And Synonyms Of Fica In The English Dictionary

Self-employed workers and independent contractors pay both the employer and employee contributions for FICA.

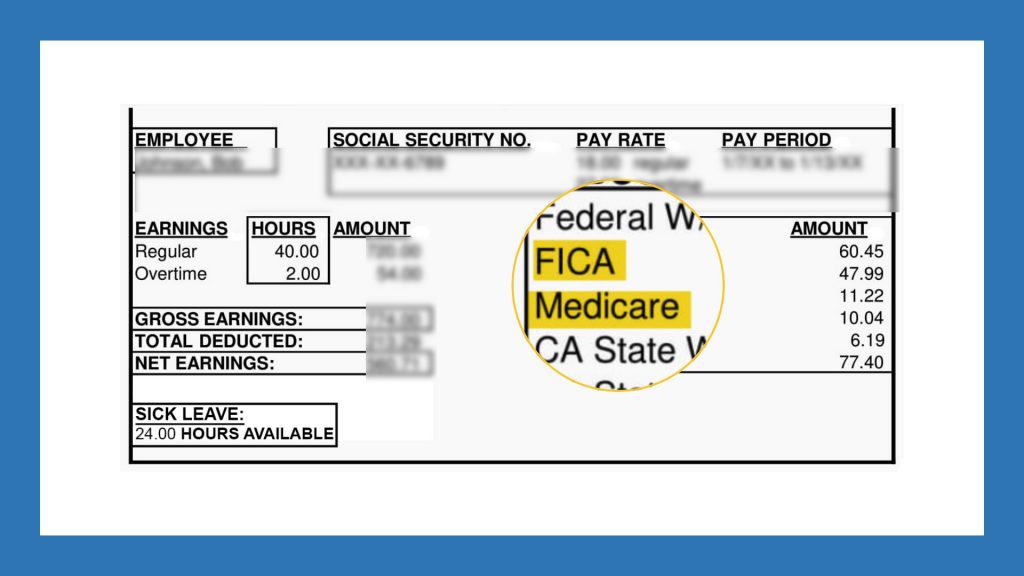

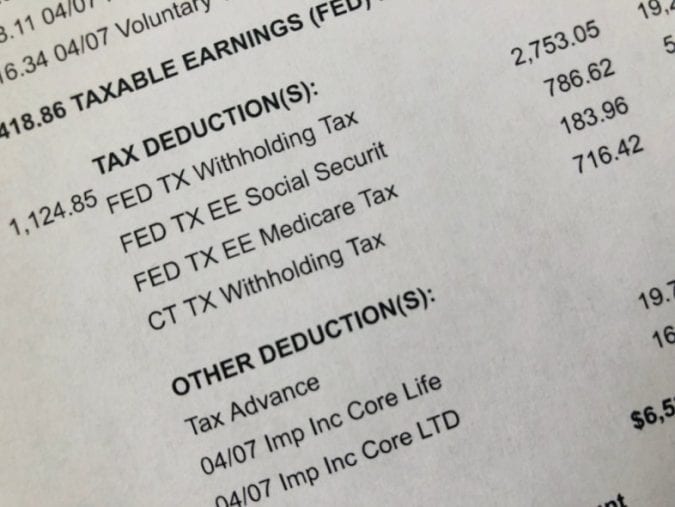

What does fica mean. FICA - Med - FICA stands for the Federal Insurance Contributions Act and Med stands for Medicare This is the Medicare contribution that you pay at 145. The Federal Insurance Contribution Act or FICA is a federal program funded through tax payments. Employers must match employee withholding and deposit the combined amount in designated government accounts.

What does FICA stand for. Fika is a concept a state of mind an attitude and an important part of Swedish cultureMany Swedes consider that it is almost essential to make time for fika every dayIt means making time for friends and colleagues to share a cup of. The Federal Insurance Contribution Act FICA is the federal law that requires employers to withhold 62 from their employees paychecks up to an annual earnings cap.

Good well very quite much. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. What does FICA mean.

What does FICA mean. FICA taxes also provide a chunk of Medicares budget. Information and translations of FICA in the most comprehensive dictionary definitions resource on the web.

FICA contains a number of control measures aimed at facilitating the detection and investigation of money laundering and terrorist financing and imposes specific responsibilities on financial institutions that relate to commencing a business relationship with a client as well as during the lifecycle of the business relationship. The Financial Intelligence Centre Act FICA. FICA does not only help curb these illegal activities but also helps to keep the money of South African citizens safe.

Most workers have FICA taxes withheld directly from their paychecks. Fika is often translated as a coffee and cake break which is kind of correct but really it is much more than that. Use for blank tiles max 2 Advanced Search Advanced Search.

FICA stands for Federal Insurance Contributions Act. By federal law every employers is required to withhold a certain portion of an employees wages and send them quarterly to the Internal Revenue Service that will in turn put them into a government trust fund for your retirement and health insurance when you retire also known as Social Security and Medicare. FICA is a US.

Employees pay 62 of their earnings for Social Security retirement benefits and their employer pays 62 for a total of 124 of a workers income. The Federal Insurance Contributions Act FICA is a US. Half of this amount is deducted from the persons tax due but this deduction doesnt affect the calculation for benefit purposesThe maximum for Social Security also applies to SECA tax and the additional Medicare tax applies to combined employment and self-employment income.

Fika A relaxing coffee and cake break. Use for blank spaces Advanced Search. FICA tax is typically 765 of earnings up to 127200 2017 figure.

The rates for self-employment tax are 129 for the Social Security portion and 29 for Medicare. The Social Security tax and the Medicare tax. Top FICA abbreviation meanings updated January 2021.

List of 71 FICA definitions. See Also in Portuguese. It stands for the.

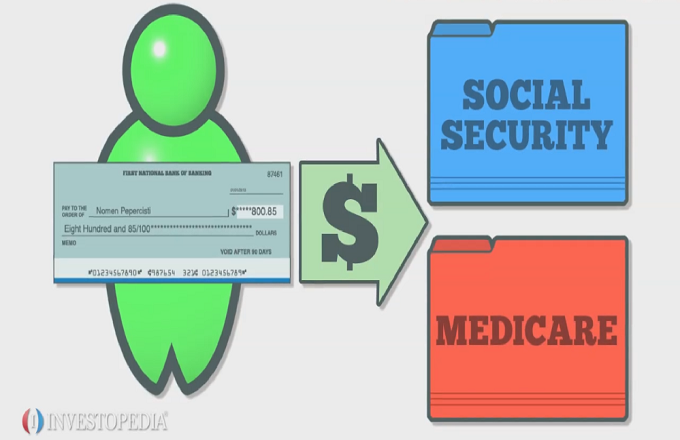

FICA noun The noun FICA has 1 sense. FICA is divided into two categories Social Security and Medicare. How does FICA work for those who are self-employed.

In 2020 its also important to keep in mind that only the first 137700 of earnings is subject to the Social Security part of the FICA tax. And is deducted from each paycheck. The FICA tax and federal income tax are similar in that the federal government collects both but they differ in their purposes.

FICA used as a noun is very rare. FICA the Federal Insurance Contributions Act refers to the taxes that largely fund Social Security retirement disability survivors spousal and childrens benefits. You also earn credits from the taxes you pay in which helps make you or your dependents eligible for future program payments.

FICA came into effect on 1 July 2001 to fight crimes such as money laundering tax evasion and other unlawful financial activities. Federal Insurance Contributions Act. See Also in English.

Federal Insurance Contributions Act FICA. A tax on employees and employers that is used to fund the Social Security system Familiarity information. It varies by year.

FICA tax is paid by both workers and their employers. Law that mandates a payroll tax on the paychecks of employees as well as contributions from employers to fund the Social Security and. The FICA tax is actually made up of two separate taxes.

FICA is separate from the federal income tax. Your contribution pays for benefits other citizens receive from the fund. What does fica bem mean in Portuguese.

This Act has put South Africa in line with similar legislation in other countries.

What Is The Fica Tax And Why Do I Have To Pay It The Motley Fool

What Is The Fica Tax And Why Do I Have To Pay It The Motley Fool

/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act Fica Definition

Federal Insurance Contributions Act Fica Definition

Fica Federal Insurance Contribution Act By Acronymsandslang Com

What Does Fica Stand For Sophisticated Edge

What Does Fica Stand For Sophisticated Edge

Fica Freund S Incomplete Adjuvant By Acronymsandslang Com

What Is The Fica Tax And Why Does It Exist Thestreet

What Is The Fica Tax And Why Does It Exist Thestreet

Fica Fellowship Of Indonesian Christians In America

Fica Fellowship Of Indonesian Christians In America

What Do They Mean By Fica Taxes Rotenbergmeril

What Do They Mean By Fica Taxes Rotenbergmeril

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

What Are The Fica Taxes On Every Payroll Check Mybanktracker

What Are The Fica Taxes On Every Payroll Check Mybanktracker

Federal Insurance Contributions Act Fica Definition

Federal Insurance Contributions Act Fica Definition

What Is Fica And Why Do We Need It Schwenn Inc

What Is Fica And Why Do We Need It Schwenn Inc

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About Fica Social Security And Medicare Taxes

Learn About Fica Social Security And Medicare Taxes

How To Calculate Fica For 2020 Workest

How To Calculate Fica For 2020 Workest

Family Finance Favs Don T Leave Teens Wondering What The Fica

Family Finance Favs Don T Leave Teens Wondering What The Fica

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

Hollywoodbets Sports Blog What Is Fica How Do I Submit Fica Documents

Hollywoodbets Sports Blog What Is Fica How Do I Submit Fica Documents

Who S Fica Why S He Getting All My Money Khi Solutionskhi Solutions

Who S Fica Why S He Getting All My Money Khi Solutionskhi Solutions

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)